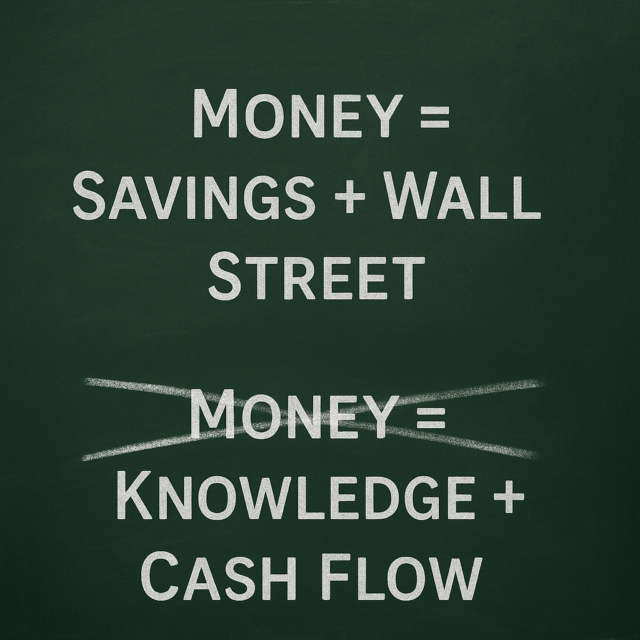

There is a money lie that keeps people broke. You have heard it from well-dressed advisors, glossy brochures, and even family members who mean well. The lie is simple: “Hand your money to smarter people and they will take care of it.”

It sounds comforting. It also keeps you from ever learning how money really works.

The incentive you cannot see is the one that costs you

Most of the financial services industry runs on commission. That does not make people bad. It does mean incentives are rarely aligned with your best outcome. Early in my career I watched a bank planner admit he routinely put clients into whatever paid him the highest commission. If a product sold well and paid more, that is where clients landed.

You see this in many corners of sales. Real estate brokers, car dealers, electronics stores. When a commission is at stake, behavior changes. The right question is not “Is commission bad?” The right question is “Whose incentive is being served?”

In my own real estate business, I do the opposite of squeezing people on fees. I pay brokers fairly because I want their maximum effort. When incentives line up, performance follows. When incentives clash, you get churn, product of the month pitches, and a portfolio you cannot explain.

Complexity is a feature, not a bug

Another tell is complexity. Products are often packaged to be as complicated as possible. If you cannot understand it, you are less likely to question it. I have had the same conversation for years with large banks calling me like clockwork to move money into the latest fund. I would ask basic questions: What is inside the fund? Why now? How does it actually make money? Silence.

Diversification has its place, but “diversified” is not the same as “productive.” At the end of the day, only productive assets pay you. Businesses that throw off cash. Real estate with real rents. Hard assets that hedge currency debasement. If an investment cannot explain how cash comes back to you, it is marketing, not a model.

What actually pays you

Here is the simple filter I use.

-

Cash-flowing, productive assets. Apartments, operating businesses, income-producing real estate. Clear inputs, clear outputs, clear tenants or customers.

-

Hard-asset hedges. I like physical gold and silver as a store of value because fiat currencies lose purchasing power over time. You might prefer oil, timber, or land. The point is owning something real, not another fee stack.

-

Cash and short duration. Liquidity for opportunity and safety.

Notice what is missing: high-fee complexity that has to be “sold.”

For years I kept some cash parked at a big bank and used GLD or SLV as simple proxies for gold and silver. I still prefer the physical metals, but the broader point stands. I chose things I understood. Meanwhile the annual “Ken, we have a new fund for you” calls kept coming. New salesperson. Same script.

“But my advisor is honest”

Good advisors exist. I have close friends in the business who put clients first, use insurance correctly for estate planning, and build truly diversified plans. The difference is transparency and education. They can explain the strategy in plain English, show you the fee stack front to back, and welcome your questions.

If you choose to work with an advisor, interview them like you would a key hire.

Five questions to ask any money manager

-

What are all the ways you get paid by me or by product providers? List every fee and commission.

-

What are the underlying holdings, and why these instead of the alternatives?

-

What is the expected source of return: cash flow, multiple expansion, rate moves, or leverage?

-

What is the downside case and how do we mitigate it? Show me the math.

-

What are you reading and who do you learn from? If the answer is a blank stare, that is your answer.

You can use a simple test too. Bring them an obviously poor investment and watch their reaction. If they rush to sell it to you, you have your answer. If they caution you and steer you toward better options, you may have found a partner.

Unlearning the school version of money

Most schools teach almost nothing about money. Family lessons are mixed at best. So we grow up believing that retirement equals handing money to other people. When you start asking better questions, you realize you are the target market for every industry: insurance, retirement products, credit cards, student loans, and even parts of real estate. That realization can feel uncomfortable. Lean into it.

I had to unlearn and relearn too. During the last cycle, I stopped buying when the numbers stopped making sense. Plenty of people kept buying. Some were angry I would not keep playing, and they chased deals elsewhere. Patience is not popular when headlines scream extremes. Popular narratives are not a strategy. Math is.

Real estate is still about aligned incentives and cash flow

This is why I love real estate. You can see it, touch it, and model it. Tenants, rents, expenses, debt, reserves. You can interview the property manager and pay the broker who brings you a great off-market deal. Incentives can be aligned and transparent.

Does that mean prices never drop or that every deal works? Of course not. It means you can control more variables than in a black-box product, and your return comes from cash that a real person pays to live or operate in a space you own.