Are We Heading for a 1970s-Style Economy?

When you’ve been investing as long as I have, you start to see patterns.

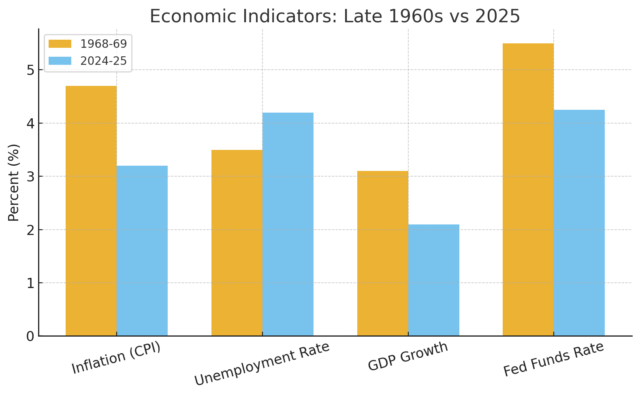

Right now, I feel like I’m standing in a stadium, watching the warm-up before the big game, and it feels an awful lot like the late 1960s.

Back then, the U.S. economy was running hot. Unemployment was low, spending was strong, and Washington was pouring money into the economy through both war spending and domestic programs. Inflation started creeping up, but policymakers were slow to react.

Then, almost overnight, the music stopped. The first recession of the 1970s hit in 1969-70, setting the stage for the stagflation decade that followed, with high inflation, rising unemployment, and a Federal Reserve scrambling to get things under control.

Sound familiar?

2025: The Echoes Are Getting Louder

Here’s where we stand today:

Inflation is still sticky. It has come down from its peaks, but it is stubbornly above the Fed’s 2% target.

The labor market is softening. We have had several months of weak job numbers and rising unemployment, very similar to the late 1960s when hiring began to stall.

The Fed just cut rates. In September, they lowered the funds rate by 0.25%, trying to ease pressure without reigniting inflation. This is exactly the balancing act they attempted back then.

Government spending is still elevated. Post-pandemic relief, infrastructure projects, and tariffs are all pumping money into the system, much like the fiscal expansion of the 1960s.

The ingredients are on the table. Whether we get a 1970s-style stagflation stew depends on what happens next.

The Big Differences

We have to be fair. Today’s economy is not an exact copy of 1969.

The Fed is more transparent and quicker to act. Inflation expectations, the thing that triggered the wage-price spiral in the 1970s, are still under control. And we are less dependent on imported oil than we were back then, which means one Middle East shock will not necessarily bring the economy to its knees.

But those differences do not make us immune. If inflation expectations start to cool, or if another supply shock hits, we could find ourselves right back in that 1970s playbook.

What This Means for Real Estate Investors

This is where experience matters. In times like this, speculation can be deadly.

I am not betting on rate cuts to save a deal. I am underwriting conservatively, assuming rents could dip, expenses could rise, and financing might not get much cheaper. If the deal still cash flows under those assumptions, it is a winner.

I am also watching for opportunities to use built-up equity strategically, through HELOCs or cash-out refinances, to improve existing properties, boost rents, and strengthen cash flow. Value-add is still king, and it is how you control your own destiny when the economy feels unpredictable.

Most importantly, I am keeping cash reserves strong. Liquidity is what keeps you in the game when weaker operators have to sell.

My Take

If I had to put a number on it, I would say 2025 is about a 7/10 match to the late 1960s economy, close enough to make me sit up and pay attention.

The warning signs are there: sticky inflation, slowing growth, political pressure on the Fed. The next 12 months will tell us whether we get a gentle slowdown or something much rougher.

Either way, investors who are disciplined, liquid, and focused on fundamentals are going to have the upper hand.

Real estate is a marathon, not a sprint. And right now, we are in mile 3 of what could be a very interesting race.