Every week we hear new warnings about artificial intelligence. Some analysts say AI will replace lower and middle-income jobs. Others argue it will concentrate even more power in the hands of the top one percent. Ray Dalio recently pointed out that sixty percent of Americans cannot read at a sixth-grade level. He believes that makes the bottom sixty percent even more dependent on the top earners to keep the economy moving.

We are already seeing early signs. A recent report from J.P. Morgan highlighted high unemployment among recent college graduates and weak job growth in white-collar fields that AI can easily replicate. People are right to ask hard questions. What happens to workers who cannot compete in a knowledge-driven economy? What happens when entire career paths shrink?

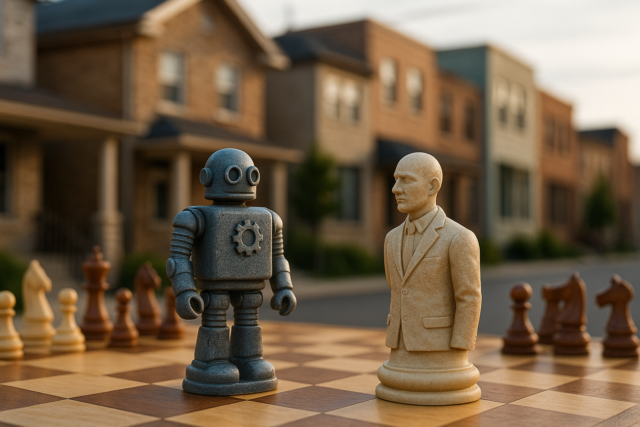

But the bigger question for investors is this. What happens to real estate?

The truth is that real estate income, both active and passive, is far more AI resilient than most people realize.

Real Estate Businesses That AI Cannot Replace

There are dozens of real estate niches that require human judgment, in person decision making, and boots on the ground execution. AI tools might help with tasks, but they cannot replace the business itself.

Flipping Houses

Flipping is one of the most human driven businesses in the entire industry. You still have to:

-

Market to distressed sellers

-

Negotiate face to face

-

Walk properties and estimate repairs

-

Arrange financing

-

Pull permits

-

Hire and manage contractors

-

Oversee renovations

-

Coordinate inspections

-

Stage and list the property

-

Negotiate with buyers

No algorithm is going to walk a rehab project or convince a seller to accept a discounted offer. Flipping will use AI tools, but AI will never run the business.

Rental Property Investing

Whether you are using the BRRRR method or buying turnkey rentals, the process still requires human involvement. You need inspections, financing, permits, property management oversight, and tenant communication. Calling rental investing passive is misleading. It is a business, and real estate businesses need people.

Wholesaling

Wholesalers rely on one skill that AI cannot replace. Human to human negotiation. You still have to build rapport, evaluate property condition, negotiate with the seller, and cultivate a network of investors who trust you. AI cannot build that trust for you.

Land Flipping

Land flipping is more automated, but it still requires human judgment. You can automate marketing and paperwork, but you still make the decisions and negotiate deals. AI can support the business, not run it.

Across all these active strategies, real estate works because it is hands on. The steps, relationships, and decisions cannot be outsourced to software.

Passive Real Estate Investments Are AI Proof Too

Not everyone wants to run a real estate business. Many people want reliable passive income. The good news is that passive real estate strategies are just as AI resilient.

Private Partnerships

You can invest as a silent partner in real estate operators’ deals. These operators run the business and share profits with you. Whether it is a flip, a spec home project, or another niche, you earn returns from real assets handled by real people.

Real Estate Syndications

Syndications allow investors to own a portion of large real estate projects. You become a limited partner in apartment complexes, industrial buildings, mobile home parks, or other commercial properties. You are on the title of the real property and earn passive cash flow and appreciation.

Real Estate Funds

Operators who flip land or build properties often raise capital privately and pay consistent returns. The work cannot be automated, so the income stream is rooted in real world action, not software.

Private Notes

Private lending is one of the simplest AI resilient strategies. You lend money on a secured note backed by real property, earning a fixed return. The borrower still has to run a business, manage projects, and create value in the physical world.

Why AI Cannot Replace Real Estate

Real estate is physical. Buildings must be constructed, renovated, inspected, leased, and maintained. People need places to live, work, learn, eat, and gather. Demand for physical space is not going away. Even with AI, the world still needs homes, apartments, storage facilities, industrial buildings, and retail centers.

AI can make real estate more efficient. It can sort data, help value properties, and automate parts of the workflow. But it cannot:

-

Crawl under a house to inspect plumbing

-

Walk a property with a buyer

-

Swing a hammer

-

Negotiate face to face

-

Build trust with a seller

-

Convince a tenant to renew

-

Operate a construction crew

Real estate requires human presence. That is what makes it one of the most AI resilient industries in the economy.

The Smart Move in an AI Driven Economy

If AI is a greater threat to employees than entrepreneurs, the answer is simple. Become the entrepreneur. Own assets. Invest in real property. Build or buy income streams that cannot be automated.

If you want AI resilient wealth, real estate is one of the most reliable paths.