What History Teaches Us About Recessions (And How to Prepare for the Next One)

Recessions aren’t new, and they aren’t going away. Whether we are in one right now or heading toward one, what matters most is not the cause of a downturn but how governments and central banks respond to it.

After 30+ years in real estate and living through multiple economic cycles, I’ve learned that every downturn follows a pattern and so does the recovery. In this article, we will walk through a short history lesson on how the Federal Reserve and government have handled recessions over the past century, and what that means for investors like you today.

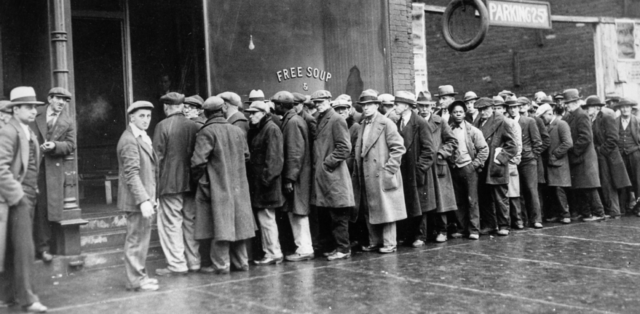

The Great Depression: The Fed’s First Big Test

The Federal Reserve was created in 1913 along with the IRS to stabilize the economy and manage the money supply. But when the stock market crashed in 1929, the Fed made its first major mistake: raising interest rates during an economic downturn.

-

Dow Jones fell nearly 90% from its peak

-

9,000 banks failed, wiping out family savings

-

Average family income dropped 40% and industrial production fell 50%

-

Unemployment hit 25%

Instead of cutting rates and adding liquidity, the Fed tightened monetary policy, which deepened the crisis and turned a recession into a decade-long depression. It wasn’t the Fed that pulled the country out, it was massive government spending through the New Deal and the industrial ramp-up of World War II.

Lesson: Deflation (falling prices) is far more destructive than inflation. When incomes fall, purchasing power collapses, which prolongs economic pain.

1970s Stagflation: The Power of Rates

Fast forward to the 1970s. The U.S. faced a different problem: stagflation, which means high inflation paired with slow economic growth.

-

Oil prices quadrupled from $3 to $12 a barrel

-

Inflation peaked at 13.5%

-

Unemployment rose above 9%

-

Mortgage rates hit a staggering 18-20% by 1981

Fed Chair Paul Volcker chose to “rip the band-aid off,” aggressively raising interest rates to crush inflation. It worked, but not without pain. The economy went through a brutal recession before recovery began.

Lesson: When rates stay too low for too long, bubbles form. Raising rates too late means more pain when the bubble bursts.

The 2000 Dot-Com Bust and the 2008 Housing Crash

Cheap money fuels speculation, and we saw this again during the dot-com bubble (2000–2001) and the Great Financial Crisis (2008).

-

In 2000, the Fed dropped rates from 6.5% to 1%, which set the stage for the housing boom

-

By 2006, home prices had surged 80% in less than a decade

-

“No-doc” and subprime loans made it possible for almost anyone to buy a house

-

When rates rose again, 6 million homes foreclosed between 2007 and 2014

The Fed responded by cutting rates to zero and launching quantitative easing (buying bonds and mortgages directly). This cheap debt made it a fantastic time to buy real estate if you had the capital.

Lesson: Every recession leads to lower interest rates, which create the next asset bubble. Smart investors take advantage of these windows rather than fearing them.

COVID Recession and Today’s Economy

In 2020, the Fed acted quickly, slashing rates to zero and flooding the system with liquidity. The result:

-

A rapid recovery in home prices

-

Record-breaking inflation that peaked in 2022

-

Today, we are in a cycle where rates have risen to fight inflation and now we are seeing unemployment tick up

Historically, when unemployment rises, the Fed cuts rates. We just saw the first rate cut in this cycle, and there may be more coming, especially under a White House that is signaling it wants rates 3% lower.

What Investors Should Do Now

Here’s how I’m thinking about this cycle and what you can do to position yourself:

1. If You’re a Worker

-

Don’t expect big raises right now because companies are tightening

-

Build strong relationships where you work, as job-hopping is riskier in a cooling labor market

2. If You’re a Homebuyer

-

Watch for falling mortgage rates since they will unlock inventory and create a short buying window

-

Be ready to act quickly because these windows typically last 3 to 5 years before the next bubble forms

3. If You’re an Investor

-

Focus on cash flow over appreciation

-

Underwrite conservatively and assume flat rent growth for the next 24 months

-

Get ready for more motivated sellers as rates drop and cap rates adjust

Key Takeaway: The Cure Creates the Next Cycle

Every recession is followed by stimulus, lower rates, and more government spending, which plant the seeds for the next bubble.

Inflation may be painful, but deflation is worse. If you understand how the Fed responds, you can position yourself to benefit during these cycles instead of getting wiped out.

Remember: when others are afraid to invest, that is often the best time to buy.