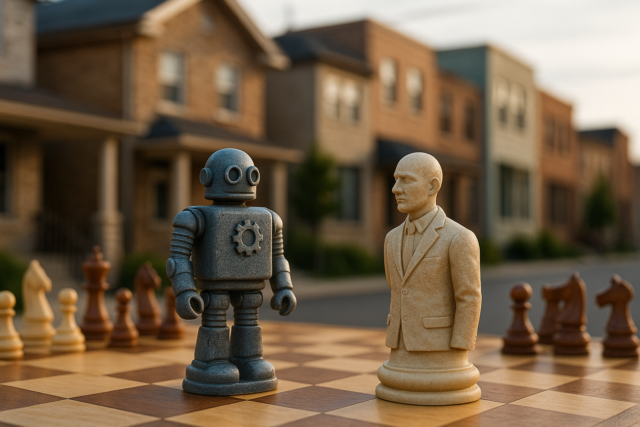

The Future of Real Estate: Humans + AI (Not Humans vs. AI)

By Ken McElroy,

Artificial Intelligence (AI) is transforming industries and real estate is no exception. Today, algorithms can scan thousands of data points in seconds, from rent growth and job creation to construction pipelines and demographic shifts. For many investors, that sounds like a dream: an AI that tells you where to invest and when.

But here’s the real question:

Would you trust AI to pick your next multi-million-dollar real estate deal? Without ever setting foot in the neighborhood?

AI’s Growing Role in Real Estate Investing

Real estate has always been a numbers game. Successful investors track occupancy, rental growth, supply and demand, population trends, and dozens of other metrics. AI just does it faster and at a scale that humans never could.

-

Market Analysis: AI platforms can quickly identify markets with rising rents and low vacancies.

-

Deal Screening: Algorithms can flag underpriced assets or high-risk properties instantly.

-

Forecasting: Machine learning models can predict future demand with impressive accuracy.

For institutional investors, this data-driven approach is game-changing. It reduces risk, eliminates hours of manual research, and speeds up decision-making.

But there’s a catch, and this is where most people get it wrong.

The Limitations of AI: What It Can’t See

AI can crunch data, but it can’t walk a property. It doesn’t smell the hallway, see deferred maintenance, or notice a street lined with shuttered storefronts.

In my 30+ years of investing, some of my best deals came from observations you could never find in a spreadsheet:

-

A “C” class property on paper that felt like a solid “B” when you walked the units.

-

A market that looked overbuilt in the data, but you could see construction cranes signaling new jobs and demand coming soon.

-

A neighborhood about to gentrify because you spotted trendy restaurants and coffee shops popping up before the stats reflected it.

Real estate is hyper-local. You can’t outsource the feel of a neighborhood to an algorithm.

Why Human Insight Still Wins

At the end of the day, real estate is about people, where they live, work, and spend their money. AI can’t talk to a local broker about why occupancy just dropped 10%. It can’t ask the property manager why half the tenants are leaving.

Human insight brings context. It gives you the “why” behind the numbers.

The Future: Humans + AI, Not Humans vs. AI

The best investors will use AI as a tool. Not as a replacement. Here’s how I approach it:

-

Let AI Do the Heavy Lifting: Use data platforms to filter and rank potential markets.

-

Verify with Boots on the Ground: Walk the property, tour the comps, talk to brokers and lenders.

-

Trust Your Gut: If the numbers say “buy” but the market feels wrong, don’t ignore that instinct.

This combination, AI for efficiency, human experience for judgment gives you the best of both worlds.

Takeaway for Investors

AI is here to stay, and it’s only getting better. But real estate will always reward those who combine data with human intuition. The investors who win in 2025 and beyond will be the ones who blend AI-powered insight with hands-on market knowledge.

So, would I trust AI to pick my next deal? Not without walking the neighborhood first.