Real Estate Crashes Are Predictable

What if I told you that real estate crashes are predictable? You can’t circle a date on the calendar, but the conditions are always the same. After more than 35 years of investing, through booms and busts, I’ve learned to recognize the warning signs long before things collapse.

Crashes don’t happen overnight. They build slowly, cracks form, and then one event tips the system over. Let’s break down the five warning signs of a real estate crash, look at real-world examples, and compare them with what’s happening right now in 2025.

Five Warning Signs of a Real Estate Crash

1. Prices Detach from Fundamentals

When investors stop buying for cash flow and start buying only for appreciation, trouble is near. You’ll hear things like “It’s different this time” or “Prices will always go up.” But when numbers stop making sense, it’s only a matter of time before reality catches up.

2. Cheap and Easy Debt

Every crash is fueled by loose lending. When banks start offering zero-down loans, teaser rates, and adjustable bridge debt, discipline disappears. Operators assume they’ll refinance later, but if rates rise, those bets collapse.

3. Overbuilding and Overconfidence

Developers rush in late and flood the market. Because construction lags 2–3 years, oversupply hits just as demand weakens. Suddenly, rents stall, vacancies rise, and concessions creep back in, wrecking pro formas.

4. Rising Delinquencies

Before prices fall, tenants start struggling. You’ll see rent concessions, one month free, two months free, even four months free, which is really just a disguised rent cut. This signals weak demand long before headlines call it a crash.

5. A Triggering Event

The final domino is usually a rate hike, inflation spike, or economic slowdown. We saw it in June 2022 when inflation hit 9% and the Fed slammed on the brakes. Crashes always need a trigger, and when it hits, overleveraged deals collapse.

Lessons from Past Real Estate Crises

History repeats itself because the fundamentals don’t change. Here are three examples every investor should study:

-

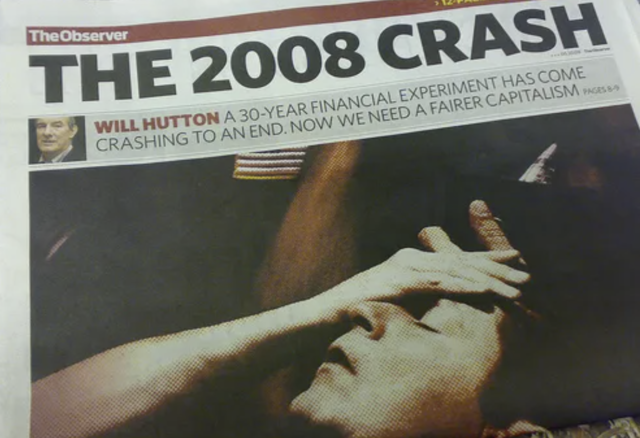

2008 Global Financial Crisis – Fueled by subprime loans, no-doc lending, and adjustable-rate mortgages. When rates reset, millions defaulted. The lesson: cash flow matters more than hype.

-

Japan’s Real Estate Bubble (1990s) – Land in Tokyo was once worth more than all of California. When credit tightened, values collapsed, and it took 30 years to recover. The lesson: easy credit + speculation = disaster.

-

Spain’s Housing Crash (2008) – Over 800,000 homes were built annually, more than France, the UK, and Germany combined. Oversupply and speculation created ghost cities. The lesson: when you’re surrounded by cranes, it’s already too late.

Are We Headed for a Crash in 2025?

Today, the same warning signs are flashing:

-

High Prices & Low Affordability – Homeownership is out of reach for many, forcing more people into rentals.

-

Elevated Interest Rates – Owners who bought in 2021–22 with floating debt are now crushed by payments nearly double what they budgeted.

-

Rising Costs – Property taxes and insurance, especially in Texas and Florida, are wiping out cash flow.

-

Multifamily Defaults – Syndicators who bet on appreciation instead of fundamentals are already in trouble.

-

New Supply Still Coming Online – Projects started in 2021–22 are hitting the market just as demand softens.

This isn’t 2008, but a silent reckoning is underway. The investors who bought on hype are suffering. The ones who bought on numbers and cash flow are positioned to win.

How to Protect Yourself and Capitalize

-

Buy for Cash Flow, Not Appreciation – Appreciation is a bonus, not a strategy.

-

Use Fixed-Rate Debt – Don’t gamble on future rate drops. Lock in what you can control.

-

Stress Test Every Deal – Ask: if rents drop 5% and expenses rise 10%, will I survive?

-

Focus on Strong Markets – Look for population growth, job growth, and limited supply. Real estate only thrives where people move.

-

Stay Patient – Distressed deals are already surfacing. Be ready to act when others panic.

Final Thoughts

Every crash looks different, but the warning signs never change: cheap debt, overbuilding, emotional buying, and speculation. The investors who stay disciplined, who buy for cash flow, secure fixed debt, and stick to strong markets, will always come out ahead.

Want more strategies on navigating the 2025 market? Be sure to download my free guide on navigating real estate and inflation: DOWNLOAD HERE