Most people grow up hearing one thing about debt. Debt is bad. Stay out of debt. Cut up your credit cards. Live below your means. Experts like Dave Ramsey or Suze Orman often convey this message because they are speaking to people who already struggle with debt. They are teaching basic financial safety. I respect that. But if you want to build wealth, you need to understand a far more powerful truth. Debt is not the problem. Misused debt is the problem.

Good debt is one of the greatest tools in the world for building wealth. I know because I used it to scale from making seven hundred dollars a month managing a sixty unit building to owning more than ten thousand units today. If you understand how debt works, who pays it off, and how inflation and cash flow work together, you will see why most wealthy people use debt strategically. They do not run from it.

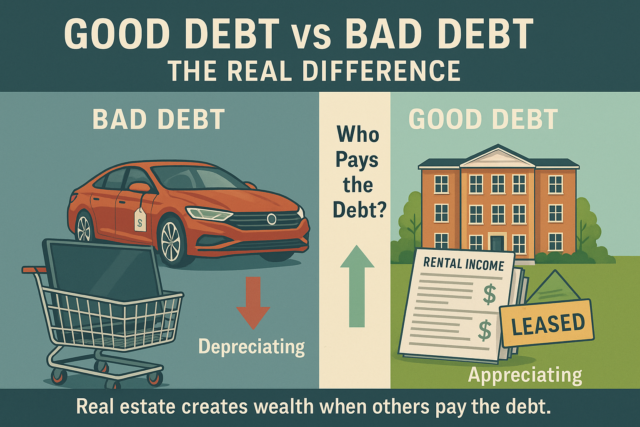

Let’s start by separating good debt from bad debt.

The Difference Between Good Debt and Bad Debt

Bad debt is debt that comes out of your pocket. It drains your income. It funds things that are worth less tomorrow than they were today. A new car is the perfect example. Spend one hundred thousand dollars on a new vehicle with five or ten grand down and ninety grand financed and the moment you drive it off the lot it drops in value. Your monthly payments come from your income. The car does not produce anything. It is a depreciating asset.

The same goes for TVs, boats, or any other luxury items. I own fun things too. I have cars, a boat, and jet skis. I own all of them with cash. I never take on debt for toys. That is because these items go down in value and they cost money to maintain.

Good debt is very different. Good debt is used to buy appreciating assets. In other words, the asset pays off the debt, not you. Rental properties are the best example. When you buy a property that cash flows, your tenant pays the mortgage, the taxes, the insurance, and ideally puts extra cash in your pocket every month. Over time you gain equity and the property rises in value.

The simplest test is this. Who pays the debt? You or someone else? If you pay it, it is almost always bad debt. If the asset pays it, it is almost always good debt.

Even your primary residence can fall into the good debt category. You are paying it off yourself, but it also appreciates and becomes part of your net worth. For many families, their home becomes their largest wealth-building asset by the time they retire.

What About Student Loans?

Student debt is the perfect “it depends” category. The real question is return on investment. If you spend two hundred thousand dollars to enter a field where you will make thirty or forty thousand dollars a year, the math does not work. But if you spend the same amount for a profession that begins at one hundred to two hundred thousand dollars per year, the debt becomes strategic.

The degree is not the point. The payoff is the point.

Why You Do Not Need to Start With Money

Many people think real estate investing is only for the wealthy. It is the opposite. Real estate becomes the vehicle that creates wealth because of OPM, which stands for Other People’s Money. Banks, private lenders, and partners are all using the same system you already participate in as a worker. Every time you deposit money into a bank, the bank lends it to someone else. Banks do not make money by storing your cash. They make money by lending it.

When you buy a good deal, banks want to lend to you. Investors want to partner with you. They all participate because the deal pays everyone back. The deal is always the engine. If it produces income and grows in value, you do not need to be rich. You just need to find an opportunity that makes sense.

How Inflation Supercharges Real Estate

Inflation hurts savers but rewards asset owners. Here is why. If inflation is three percent per year and you buy a five hundred thousand dollar house, that property rises by about fifteen thousand dollars in year one. If you only put one hundred thousand dollars down, that means you gained fifteen thousand dollars on your down payment and another twelve thousand in inflated value on the bank’s portion. You benefit from inflation on money that is not even yours.

This is one of the most powerful wealth-building forces in real estate, especially in the United States where we have true fixed thirty year debt. Your payment stays the same, but rents rise over time. Most countries do not have this structure, which is why American real estate continues to outperform.

Why Real Estate Survives Downturns

Stocks and crypto can drop overnight. You have almost no control. Real estate is different. If values decline, your cash flow is what matters. As long as the rents cover the expenses, you can ride out downturns. And you have many levers you can pull. You can adjust management, control expenses, add income streams, or offer incentives to keep tenants. Investors have options. Stockholders do not.

Real Estate and Generational Wealth

Real estate is one of the strongest vehicles for building generational wealth. Investors can use tools like the IRS 1031 exchange to defer taxes or move assets into trusts that continue to grow. Combined with long term appreciation and cash flow, real estate becomes a powerful legacy tool.

The Bottom Line

Not all debt is equal. Good debt builds wealth. Bad debt destroys it. Other people’s money lets you scale faster than your savings ever could. Inflation works in your favor when you own real assets. Cash flow protects you in downturns.

If you want to escape the cycle of working for every dollar, learn how to use debt the right way. Wealth is built by those who understand the rules, not by those who fear them.

Ready to Learn the System?

Inside KenPro, I teach the frameworks, strategies, and real-world lessons I wish I had when I began. If you are serious about building wealth, ownership, and long-term independence through real estate, this is where your journey begins.